tax on unrealized gains crypto

Similarly if the price of BTC dropped to 25000 youd have an unrealized loss of 5000. Similar to what happened in 1914 this annual tax is aimed only at the richest people in the United States.

![]()

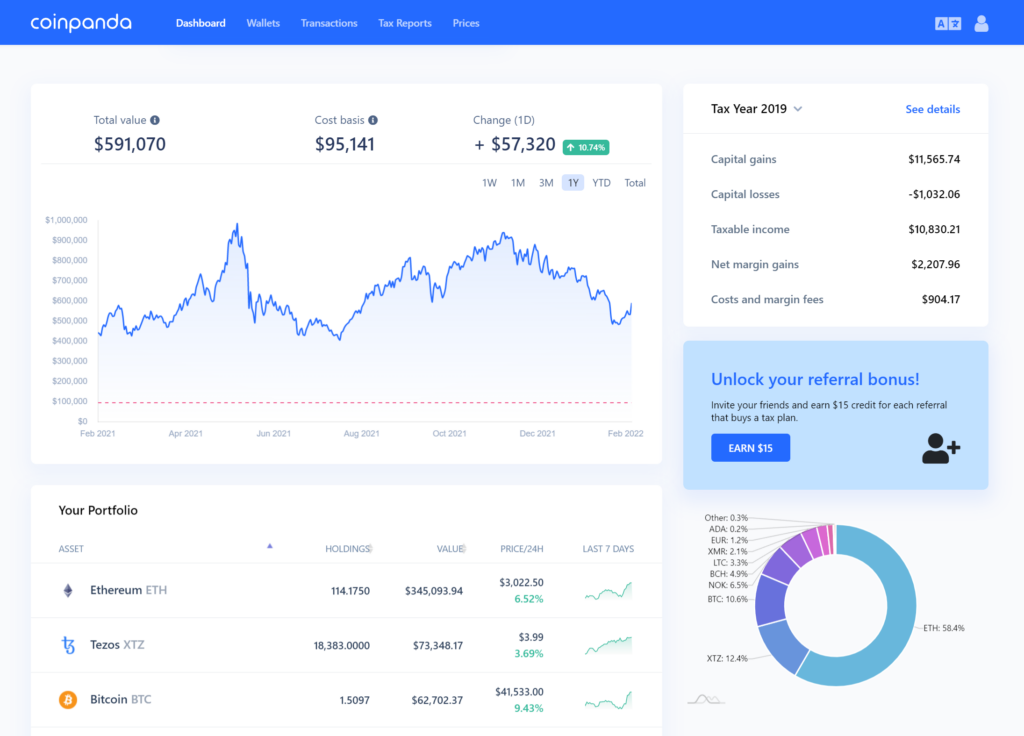

Cointracking Info Review Leader In Crypto Tracking And Tax Reporting Jean Galea

Long-term gains are taxed at a reduced capital gains rate.

. This means that holders of cryptocurrency or stocks could be taxed on increases before they have even sold the assets. An unrealized capital gains tax on corporate assets could hit those with real estate especially hard but companies with bitcoin also come to mind. Speaking to CNN on Sunday the former Federal Reserve chair said the measures would target liquid assets held by extremely wealthy individuals.

Value at the time of selling - Cost Basis Capital Gain. However as its historical counterpart the new tax on unrealized gains may very well morph. President Joe Bidens proposal to tax the unrealized gains of some of the richest Americans has taken legislative form with a new bill from two House Democrats.

Annual income 35000 and the long-term capital gains tax rate for this income is 0. While realized PL is static unrealized PL is always changing depending on the market. Short-term capital gains are taxed at 10-37 while long-term capital gains are taxed at 0-20 in 2021.

But reports in January suggested that unrealized gains would âœbe taxed at the same rate as all other incomeâ namely up to 37. For example if you bought 1 BTC for 30000 and the price of BTC has increased to 40000. Comparing the two charts these rates are lower than the short-term capital gains rate so it is considered a tax advantage to hold your crypto assets for more than 12 months.

Talk of a tax on unrealized capital gains has surfaced again as politicians seek ways to squeeze as much out of the American people as they can to fund. You have an unrealized profit of 10000. She spoke on CNN of the need to ensure a.

The long-term capital gains tax rate in the US is either 0 15 or 20 depending on your total ordinary income. American stocks and crypto holders are braced for another tax-themed body blow from the government with House Speaker Nancy Pelosi claiming that a wealth tax an unrealized capital gains levy on its way to Congress as early as this week after striking an agreement on a spending plan in the House. For federal taxes the crypto tax rate is the same as the capital gains tax rate.

Japanese politician Masaaki Taira also argued that lawmakers need to relax crypto regulations to stem the outflow of digital talent. He expects a 35 tax rate long term capital gains and for the stock market to grow 10 annually while an opportunity zone investment would appreciate 9 annually net of fees. However part of the proposals included a tax that could be applied to unrealized capital gains.

These are currently taxed at 0 15 or 20 depending on your income and filing status. If your taxable income is less than 80000 your long-term gains are in fact not taxed at all. Charitable Remainder Trust NIMCRUT.

Unrealized hold a crypto- no realized gain- no taxable event-no tax Realized sell a crypto for fiat - realized gain- taxable event- report and pay tax There are however some less obvious transactions that trigger taxable events in the eyes of the CRA. When you sell your crypto you have to pay taxes capital gains or income which can be calculated using the formula. Biden is proposing to increase the highest long-term capital gains tax rate from 20 to 396 for those who make over 1 million dollars of income.

This is great news for any. This also assumes a base level of expenses for each strategy. The proposed 20 tax on unrealized gains put forward by the US Department of Treasury s 2023 Revenue Proposal could potentially become a penalty for being successful according to Shehan Chandrasekera Head of Tax Strategy at crypto tax software specialist CoinTracker.

On the other hand a tax on unrealized gains could shift from making the government money to costing it money if the downturn is bad enough. It could also mean that appreciation in property prices could also be taxed even before the property has been sold. South Korea postpones 20 tax on crypto gains to 2025.

Is exploring plans to tax unrealized capital gains sparking fierce criticism on Crypto Twitter. Rather there is a proposal floating around that would impose a 15 minimum tax on all corporations as the former Alternative Minimum Tax was repealed in 2017. The United States determines crypto-asset profits using two factors.

Yellen argued that capital gains are an extraordinarily large part of the. The tax could make use of a âœmark to marketâ methodology which measures the fair value of assets whose worth can fluctuate over time quite possibly including crypto. If you held onto your crypto for more than a year before selling youll generally pay a lower rate than if you sold right away.

The idea is to tax a portion of the population on their figurative gains. These rates 0 15 or 20 at the federal level vary based on your income. Billionaires may be the first target but a successful deployment could see the net widen.

This tax hike would negatively impact crypto. Talk of a tax on unrealized capital gains has resurfaced. The IRS requires that you track your crypto transactions throughout the entire year and then calculate and report your capital gains and losses on various IRS tax forms including.

Crypto tax rates range from 0 to 37 depending on several factors including whether your cryptocurrency is taxed as ordinary income short-term capital gains or long-term capital gains. Including assets such as unrealized gains from volatile assets such as cryptocurrency in. 2152019 additional 57 return.

Your income and the length of time you owned the coin holding period. Treasury Secretary Janet Yellen has revealed that the US. The bill which.

Understanding Tax Calculation Accounting Methods. Recently US secretary of the treasury Janet Yellen was on CNN explaining that the government is pushing for a tax on unrealized capital gains. Voicing the concern shared by a significant part of the crypto industry.

Watanabe is one of several CEOs who relocated their crypto companies to Singapore citing high taxes as one of the reasons for the transition.

Democrats Weigh A Tax On Billionaires Unrealized Capital Gains The New York Times

Best Tallyprime Alternatives From Around The Web

How Are Realized Profits Different From Unrealized Or So Called Paper Profits

Realized Vs Unrealized Gains And Losses Partners In Fire

![]()

Interview New Partnership Between Wealthica And Cointracking Journey To 100b Wealthica

![]()

Cointracking Review And Tutorial Best Tax Calculator 2022

Understanding Crypto Taxes Coinbase

Top 15 Crypto Tax Service Providers

Is Crypto Taxed In Canada Canadian Crypto Tax Guide 2022 Netcoins

Best Crypto Tax Software 2022 Reviews Comparison

![]()

Cointracking Info Review Leader In Crypto Tracking And Tax Reporting Jean Galea

What To Know About Declaring Crypto When You File Your Tax Return Think Local Castanet Net

Top 15 Crypto Tax Service Providers

Understanding Crypto Taxes Coinbase

Is Crypto Taxed In Canada Netcoins

Cryptocurrency Traders Owe Massive Taxes On Fat 2017 Gains

Understanding Crypto Taxes Coinbase

Will Buying Bitcoin Impact My Tax Return The Motley Fool

![]()

Top 5 Best Crypto Portfolio Tracker And Management Apps 2020 Reviewed